Earlier this month, Tether, the leading stablecoin issuer by market capitalization, released its first-quarter reserve and profit data. It’s not just impressive; it’s exceptionally impressive. Let’s take a look at a few highlights:

The net profit for the first quarter was $1.48 billion, more than double the profit from the fourth quarter of 2022! To put it in perspective, the renowned asset management company BlackRock had a net profit of only $1.16 billion in the first quarter, with nearly 20,000 employees. How many employees does Tether have globally? Probably only around one or two hundred.

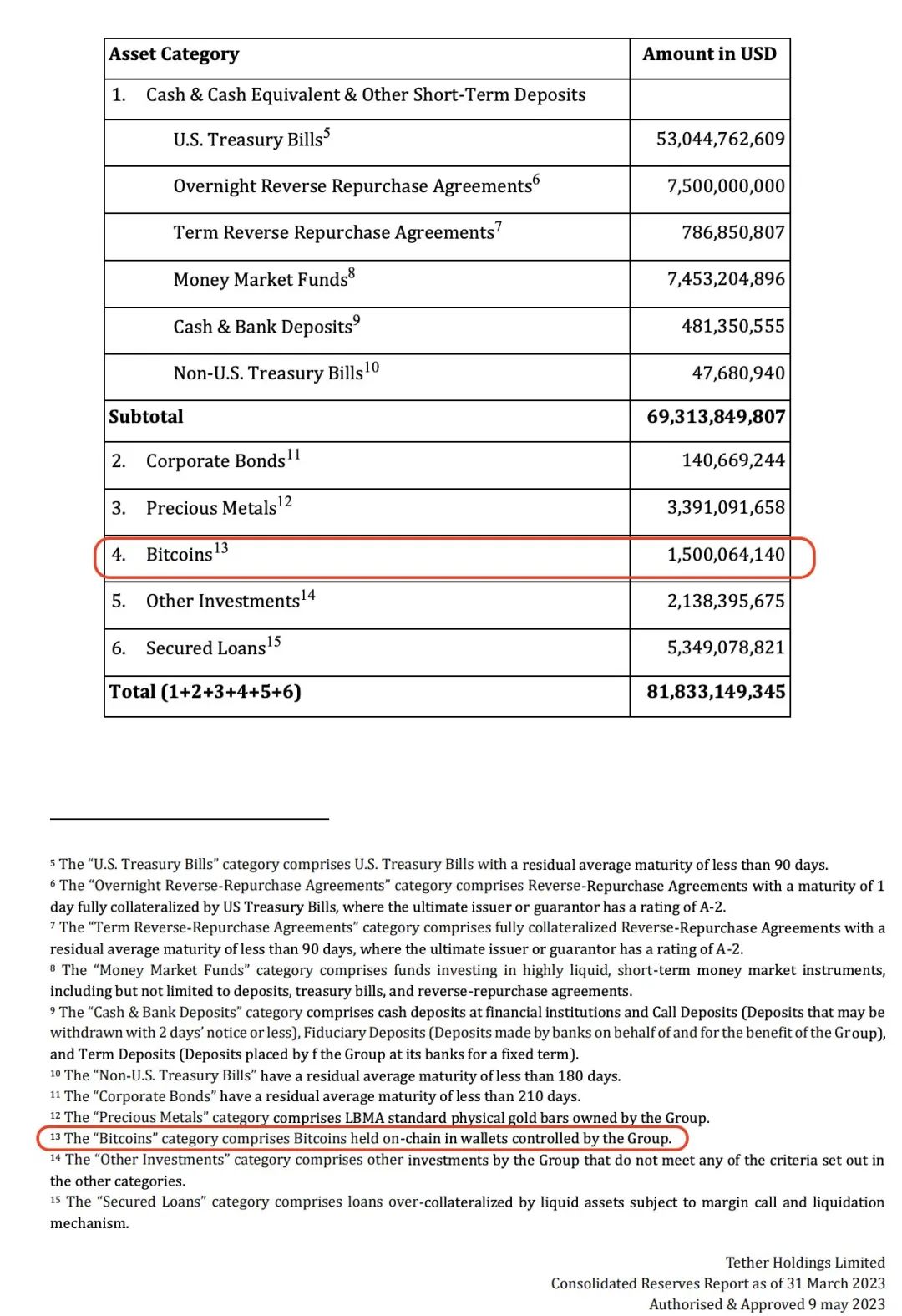

The issuance of USDT increased from $66 billion to over $82 billion. The primary reserve assets are U.S. Treasury bonds, accounting for over $53 billion (over 64%). They significantly reduced their bank deposits from $5.3 billion to $481 million. (One can only say that Tether made a swift move during the banking crisis!)

While the Federal Reserve bears the risk of bank failures and desperately raises interest rates to fight inflation, Tether made a bold move by buying U.S. bonds at a discount. The more interest the Federal Reserve raises, the more profit Tether receives, and the interest becomes mere surplus. Tether, holding a substantial amount of low-priced, high-yielding U.S. bonds, has become a significant beneficiary of this forced liquidity injection.

- On the 17th, Tether announced that starting in May, it would allocate up to 15% of its profits to “buy the dip” in Bitcoin!

Assuming they can maintain their profit level, with a first-quarter profit of $1.48 billion over three months, that’s approximately $493 million per month. 15% of that is $74 million. Based on the average purchase price of Bitcoin at $28,000, that’s over 2,600 Bitcoins per month. How many Bitcoins can miners produce in a month? Each block yields 6.25 Bitcoins, which amounts to 900 Bitcoins per day or 27,000 Bitcoins per month. So, Tether alone can purchase around 10% of the monthly increase.

The game is about to get interesting. With the Federal Reserve maintaining high interest rates, they are providing Tether with a higher risk-free rate, allowing Tether to profit significantly from seigniorage. After all, Tether doesn’t have to pay a penny in interest to USDT holders, while the Federal Reserve offers an interest rate as high as 5%. If Tether’s reserves available for capturing this interest rate differential amount to $50 billion, that’s a solid $2.5 billion in revenue.

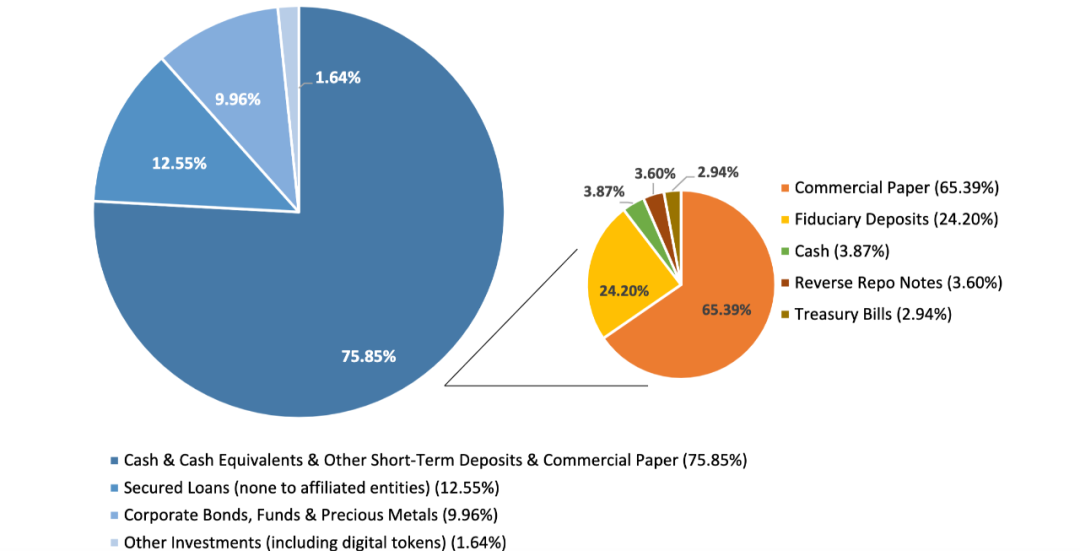

If we look back at Tether’s reserve composition during the bullish market two years ago when the Federal Reserve lowered interest rates and flooded the market while the US dollar weakened, we’ll find that just two years ago, their primary assets were commercial papers, with Treasury bills accounting for only 2.94% of their liquid assets.

The Federal Reserve’s interest rate hikes caused Silicon Valley Bank to collapse and nearly killed USDC. SEC regulation dealt a heavy blow to Paxos. Meanwhile, the opaque Tether mastered countercyclical adjustments and made a fortune in silence.

Small and medium-sized banks in the United States hoard Treasury bonds. When the Federal Reserve raises interest rates, they struggle with their liabilities and many go bankrupt. Tether, on the other hand, hoards Treasury bonds, so when the Federal Reserve raises rates, it’s like giving Tether free money. Tether claims to have $81.8 billion in reserves, exceeding the required amount by $2.44 billion. Excess reserves? Why worry? However, upon closer examination, not all of the $81.8 billion can be immediately liquidated. But can individual holders of USDT worldwide collectively squeeze Tether like they did with Silicon Valley Bank? It’s unlikely. That’s the brilliance of Tether.

Stablecoins are an excellent business, but they require exceptional asset management skills to withstand turbulent times without collapsing.

Comments