The stock guru Warren Buffett has always been known for his staunch anti-cryptocurrency stance.

In 2019, the Oracle of Omaha said on a television interview, “All cryptocurrencies will eventually come to a bad ending.”

In 2021, Warren Buffett’s partner, Charlie Munger, publicly criticized Bitcoin during a shareholders’ meeting, calling it “disgusting and contrary to the interests of civilization.” Warren Buffett himself has also publicly referred to Bitcoin as “rat poison” in the past.

In 2022, Warren Buffett criticized Bitcoin at a shareholder meeting, stating that it is not a productive asset and suggesting that “all the Bitcoin in the world is only worth $25.”

So, how did Warren Buffett’s Berkshire Hathaway and Bitcoin perform relative to each other during the bull and bear market cycle of 2021-2022?

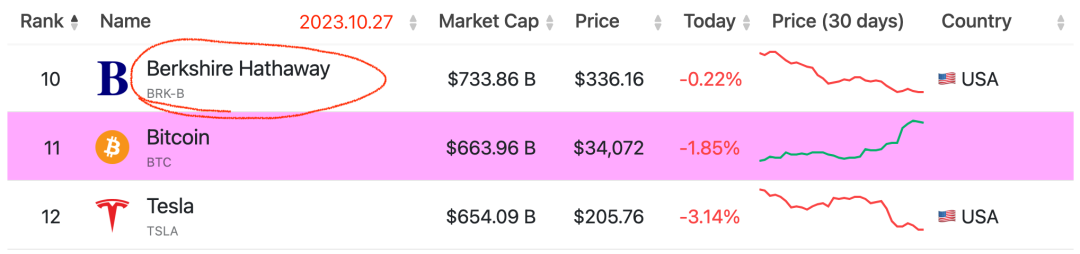

Starting from January 3, 2021, and ending on October 27, 2023, which is approximately 2 years and 10 months, the market capitalization of Berkshire Hathaway has temporarily surpassed the total market capitalization of Bitcoin.

If we only consider the total market capitalization in terms of US dollars, we are still using the US dollar as the measuring tool for wealth. Let’s change our perspective and use Bitcoin as a more openly transparent and reliable measuring tool.

Since the total market capitalization of Berkshire Hathaway is higher than that of Bitcoin, and practically speaking, it’s not possible to sell all of Berkshire’s stocks and buy Bitcoin entirely. If such an operation were attempted, Berkshire’s stock price would experience a significant discount during the selling process, while Bitcoin’s price would skyrocket.

Let’s assume that Warren Buffett takes 1% of Berkshire’s market capitalization and uses it to acquire Bitcoin. This way, we can assume that the operation will not affect the market prices of both assets.

So, in the current month of October 2023, 1% of Berkshire’s $733 billion total market capitalization is $7.33 billion, divided by the current price of Bitcoin, which is approximately $34,000, is roughly equivalent to 215,000 BTC.

This is equivalent to 1.1% of the total Bitcoin supply mined so far, which is 19.52 million BTC.

In other words, if Warren Buffett were to allocate 1% of his managed asset portfolio to Bitcoin at this point, he would own 1.1% of the total wealth measured in Bitcoin.

What about going back to January 2021? At that time, Berkshire Hathaway had a total market capitalization of $543 billion, and the price of Bitcoin was $32,000.

So, going back to January 2021, with 1% of $543 billion, which is $5.43 billion, divided by the price of Bitcoin at that time, $32,000, is roughly equivalent to 170,000 BTC. Now, let’s calculate the percentage of the total Bitcoin supply that this represents at that time.

We can use the formula 6.25 * 6 * 24 * (365 * 2 + 30 * 10) to calculate the incremental Bitcoin mined during the 2 years and 10 months, which is approximately 927,000 BTC. Using this information, we can deduce that the total mined Bitcoin supply in January 2021 was roughly 1,859.8 million BTC, which means the percentage of Bitcoin that Warren Buffett’s 1% represents at that time is about 0.9%.

In other words, not only did Warren Buffett increase the absolute quantity of Bitcoin he can exchange, but he also increased his percentage from 0.9% of the total Bitcoin supply to 1.1%. His wealth accumulation rate is faster than the rate at which new Bitcoins are being created. In other words, Bitcoin is concentrating in Warren Buffett’s hands at a faster rate, and when measured using Bitcoin as a fair benchmark, the result is that wealth inequality is increasing.

If you want to bring Warren Buffett’s percentage back to the 0.9% level at the beginning of 2021, assuming other parameters remain the same, the price of Bitcoin would need to be approximately $42,000.

In this current strong US dollar cycle that is redistributing global wealth, Warren Buffett, who understands the rules of wealth transfer and applies them effectively, is undoubtedly a big winner in the “set and win” game.

Comments